Evan Trock

Data Section

- This data shows observations about a sample of homes that have been built over a long span of time(1852-2008), It shows different types of add-ons for a house, square footage, type of street and information about the sale of the property but most of all, the sales price

- 1941 Observations in this data set

- Year Sold Ranging from 2006-2008

- No Duplicate Parcels

- Certain Variables have missing values including: v_Mas_Vnr_Area(Missing 18) v_BsmtFin_SF_1, v_BsmtFin_SF_2(Both missing 1), and v_Lot_Frontage(Missing 321)

- A couple of outliers in the Sales price category: I determined it is over 60000 for smaller houses, and lot size with lower prices looks to be over 70000.

- Data comes from a City called Ames in Iowa

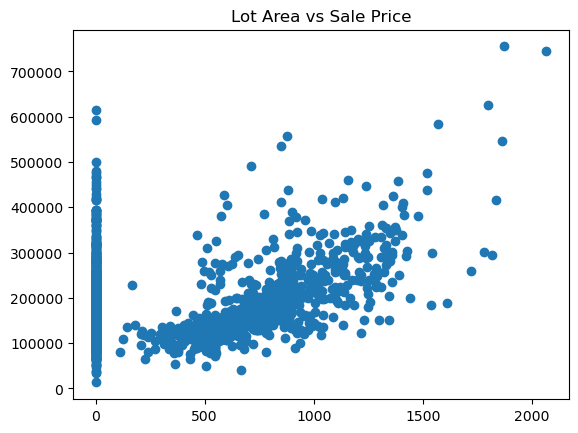

- Continous variables include but are not limited to many area variables: Lot size, price, pool_area, porch area, as well as street front property size Notes: Strong correlation between price and these variables, not as big as expected in lot size, but large correlation in square feet of 1st and 2nd floor

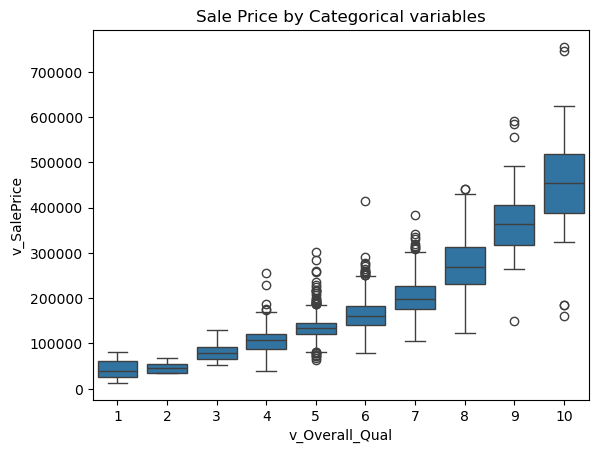

- Categorical Variables include types and styles like roof type and style, neighborhood, lot configuration and type of road access Notes: Strong correlation between price and the condition of the house at sale, showing new houses go for more, and variables like Overall quality

- Discrete Variables include number of bedrooms, kitchen, bathrooms and so on

import pandas as pd

from statsmodels.formula.api import ols as sm_ols

import numpy as np

import seaborn as sns

from statsmodels.iolib.summary2 import summary_col # nicer tables

import matplotlib.pyplot as plt

data = pd.read_csv('input_data2/housing_train.csv')

data.describe()

| v_MS_SubClass | v_Lot_Frontage | v_Lot_Area | v_Overall_Qual | v_Overall_Cond | v_Year_Built | v_Year_Remod/Add | v_Mas_Vnr_Area | v_BsmtFin_SF_1 | v_BsmtFin_SF_2 | ... | v_Wood_Deck_SF | v_Open_Porch_SF | v_Enclosed_Porch | v_3Ssn_Porch | v_Screen_Porch | v_Pool_Area | v_Misc_Val | v_Mo_Sold | v_Yr_Sold | v_SalePrice | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 1941.000000 | 1620.000000 | 1941.000000 | 1941.000000 | 1941.000000 | 1941.000000 | 1941.000000 | 1923.000000 | 1940.000000 | 1940.000000 | ... | 1941.000000 | 1941.000000 | 1941.000000 | 1941.000000 | 1941.000000 | 1941.000000 | 1941.000000 | 1941.000000 | 1941.000000 | 1941.000000 |

| mean | 58.088614 | 69.301235 | 10284.770222 | 6.113344 | 5.568264 | 1971.321999 | 1984.073158 | 104.846074 | 436.986598 | 49.247938 | ... | 92.458011 | 49.157135 | 22.947965 | 2.249871 | 16.249871 | 3.386399 | 52.553838 | 6.431221 | 2006.998454 | 182033.238022 |

| std | 42.946015 | 23.978101 | 7832.295527 | 1.401594 | 1.087465 | 30.209933 | 20.837338 | 184.982611 | 457.815715 | 169.555232 | ... | 127.020523 | 70.296277 | 65.249307 | 22.416832 | 56.748086 | 43.695267 | 616.064459 | 2.745199 | 0.801736 | 80407.100395 |

| min | 20.000000 | 21.000000 | 1470.000000 | 1.000000 | 1.000000 | 1872.000000 | 1950.000000 | 0.000000 | 0.000000 | 0.000000 | ... | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 1.000000 | 2006.000000 | 13100.000000 |

| 25% | 20.000000 | 58.000000 | 7420.000000 | 5.000000 | 5.000000 | 1953.000000 | 1965.000000 | 0.000000 | 0.000000 | 0.000000 | ... | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 5.000000 | 2006.000000 | 130000.000000 |

| 50% | 50.000000 | 68.000000 | 9450.000000 | 6.000000 | 5.000000 | 1973.000000 | 1993.000000 | 0.000000 | 361.500000 | 0.000000 | ... | 0.000000 | 28.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 6.000000 | 2007.000000 | 161900.000000 |

| 75% | 70.000000 | 80.000000 | 11631.000000 | 7.000000 | 6.000000 | 2001.000000 | 2004.000000 | 168.000000 | 735.250000 | 0.000000 | ... | 168.000000 | 72.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 8.000000 | 2008.000000 | 215000.000000 |

| max | 190.000000 | 313.000000 | 164660.000000 | 10.000000 | 9.000000 | 2008.000000 | 2009.000000 | 1600.000000 | 5644.000000 | 1474.000000 | ... | 1424.000000 | 742.000000 | 1012.000000 | 407.000000 | 576.000000 | 800.000000 | 17000.000000 | 12.000000 | 2008.000000 | 755000.000000 |

8 rows × 37 columns

# graph continuous data

plt.plot(data['v_2nd_Flr_SF'], data['v_SalePrice'], 'o')

plt.title('Lot Area vs Sale Price')

plt.show()

#Graph categorical data

sns.boxplot(x='v_Overall_Qual', y='v_SalePrice', data=data)

plt.title('Sale Price by Categorical variables')

Text(0.5, 1.0, 'Sale Price by Categorical variables')

print('Regression Results:')

reg1 = sm_ols('v_SalePrice ~ v_Lot_Area ', data=data).fit()

logLotArea = np.log(data['v_Lot_Area'])

reg2 = sm_ols('v_SalePrice ~ logLotArea ', data=data).fit()

logSalePrice = np.log(data['v_SalePrice'])

reg3 = sm_ols('logSalePrice ~ v_Lot_Area ', data=data).fit()

reg4 = sm_ols('logSalePrice ~ logLotArea ', data=data).fit()

reg5 = sm_ols('logSalePrice ~ v_Yr_Sold ', data=data).fit()

data['v_Yr_Sold_2007'] = (data['v_Yr_Sold'] == 2007).astype(int)

data['v_Yr_Sold_2008'] = (data['v_Yr_Sold'] == 2008).astype(int)

reg6 = sm_ols('logSalePrice ~ v_Yr_Sold_2007 + v_Yr_Sold_2008 ', data=data).fit()

log1stFlr = np.log(data['v_1st_Flr_SF'])

logQual = np.log(data['v_Overall_Qual'])

reg7 = sm_ols('logSalePrice ~ v_Kitchen_Qual + log1stFlr + v_Functional + logQual + v_Gr_Liv_Area ', data=data).fit()

print(summary_col(results=[reg1,reg2,reg3,reg4,reg5,reg6,reg7], # list the result obj here

float_format='%0.2f',

stars = True, # stars are easy way to see if anything is statistically significant

model_names=['No Log','Log Area','No AreaLog','Both Log','Yr Sold','2007+2008',

'5 Variable Model'],

)

)

Regression Results:

======================================================================================================

No Log Log Area No AreaLog Both Log Yr Sold 2007+2008 5 Variable Model

------------------------------------------------------------------------------------------------------

Intercept 154789.55*** -327915.80*** 11.89*** 9.41*** 22.29 12.02*** 8.48***

(2911.59) (30221.35) (0.01) (0.15) (22.94) (0.02) (0.11)

v_Lot_Area 2.65*** 0.00***

(0.23) (0.00)

logLotArea 56028.17*** 0.29***

(3315.14) (0.02)

v_Yr_Sold -0.01

(0.01)

v_Yr_Sold_2007 0.03

(0.02)

v_Yr_Sold_2008 -0.01

(0.02)

v_Kitchen_Qual[T.Fa] -0.31***

(0.03)

v_Kitchen_Qual[T.Gd] -0.10***

(0.02)

v_Kitchen_Qual[T.TA] -0.23***

(0.02)

v_Functional[T.Maj2] -0.13

(0.08)

v_Functional[T.Min1] 0.19***

(0.05)

v_Functional[T.Min2] 0.16***

(0.05)

v_Functional[T.Mod] 0.20***

(0.06)

v_Functional[T.Sal] -0.61***

(0.13)

v_Functional[T.Sev] -0.24

(0.18)

v_Functional[T.Typ] 0.24***

(0.05)

log1stFlr 0.27***

(0.01)

logQual 0.69***

(0.02)

v_Gr_Liv_Area 0.00***

(0.00)

R-squared 0.07 0.13 0.06 0.13 0.00 0.00 0.82

R-squared Adj. 0.07 0.13 0.06 0.13 -0.00 0.00 0.82

======================================================================================================

Standard errors in parentheses.

* p<.1, ** p<.05, ***p<.01

#3

print(summary_col(results=[reg5, reg6 ],

float_format='%0.6f',

stars=True,

model_names=['Reg 5', 'reg6']

)

)

=======================================

Reg 5 reg6

---------------------------------------

Intercept 22.293213 12.022869***

(22.936825) (0.016136)

v_Yr_Sold -0.005114

(0.011428)

v_Yr_Sold_2007 0.025590

(0.022246)

v_Yr_Sold_2008 -0.010282

(0.022848)

R-squared 0.000103 0.001436

R-squared Adj. -0.000412 0.000406

=======================================

Standard errors in parentheses.

* p<.1, ** p<.05, ***p<.01

- Regression outputs and R-Squared Shown above

- $\beta_1$ = 56028.17. This means that if the lot area increases by 1%, the predicted sale price increases by approximately $560.28

- $\beta_1$ = 0.000013 it’s a very small positive number, it means that for each additional square foot of lot area, the sale price increases by a .013 cents

- Looking at R squared first, Model 2 and 4 have a leg up at .13. To distinguish them, the elasticity is more interpretable for model 2 than 4 so I beleive model 2 represents the data the best.

- $\beta_1$ = -0.01. This means that, holding the effects of sales in 2007 and 2008 constant, each additional year of sale is associated with a decrease of $0.01 in sale price.

- $\alpha$ = 12.02. This represents the predicted sale price when v_Yr_Sold, v_Yr_Sold_2007, and v_Yr_Sold_2008 are all zero. In the context of this model, it’s the baseline sale price for years other than 2007 or 2008

- $\beta_1$ = .03 : This means that, holding the year of sale and the effect of 2008 constant, sales in 2007 were associated with a 0.03 increase in sale price.

- The indicator variables in model 6 provide more explanatory power, leading to a higher R-squared, even though the overall R-squared values are still very low, with the data split between 2 years for model 6

- I used logSalePrice and v_1st_Flr_SF, measuring the 1st floor square footage versus the sale price

- 0.82 is the R-Squared from my 5 variable model

- Although it could be used for a predictive regression to predicting house prices in the 2007/2008 period, I don’t think that it necessarily should as the low R squared value of .001436 suggests that it is more of a correlation rather than causation and the 2 variables are not very related.

- Similar to number 11, model 5 has a very small R-Squared value at .000103 and should not be used for predictive analysis.